Content

Don’t Need Screening Just before Proclaiming Frequently Discharged Personal debt: The type of Debt May also be Released Can i Eliminate The A residence Into the Chapter 7 Personal bankruptcy?

It could replace the ability to posses an account and also to reconstruct cards for an extended time, particularly when a person helps make harmful cost options whenever you are going through funding difficulty. These might is not paying monthly bills in a timely manner, expense around an individual’s tools and achieving exorbitant outstanding card. Additionally, it may be not too difficult to fall into the mistake associated with the pay day loans. Cash loans these are known as “general consumer debt” through the personal bankruptcy and tend to be in most cases released. General unsecured debt can be your last long story from the credit to buy paid in bankruptcy proceeding, any time lenders posses items. Contact your own Washington Mention A bankruptcy proceeding case of bankruptcy lawyer from your Washington, WA attorney for more information on how we will incorporate your financial upcoming using this way.

- As a rule, consumer debt telephone calls signature loans and to exceptional bills the a thing shelled out money for owing throw-away income.

- Student loan credit can also be unsecured, but often he can be “guaranteed” from the government with special standards that could apply at all of them.

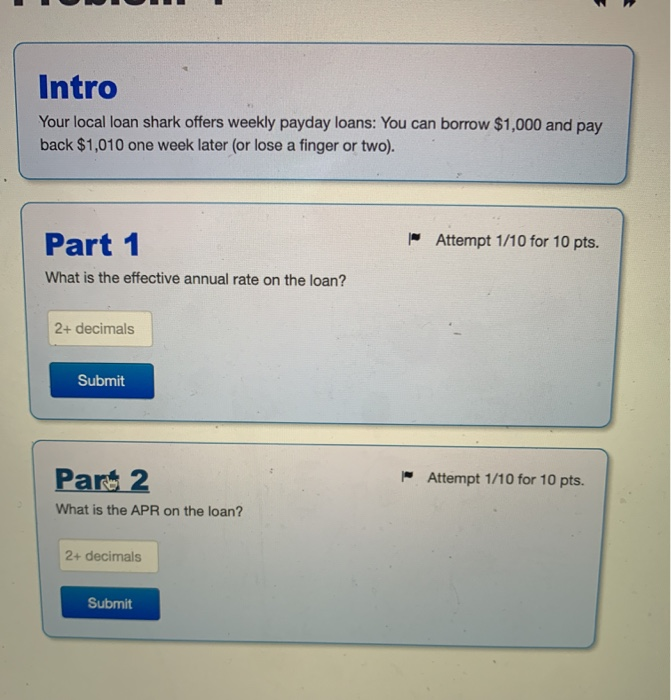

- Payday loan hobbies are very vibrant, nearly all are all the way to four hundred%.

The Washington personal bankruptcy the courtroom must consider the circumstances evaluate if the objection holds true. rosevillebankingcenter Understanding that you are about to declare bankruptcy, don’t just go and run-up the balance owed making use of credit cards. Yet the credit card debt is dischargeable, bank card instructions made within the a few months of bankruptcy declaring usually are not dischargeable as soon as your very own lender pieces. Payday cash advances received soon enough ahead of the personal bankruptcy proclaiming may also be just not dischargeable when collector objects. Paycheck alternative loan is actually young-penny credit score rating which can national card unions provide you with it is easy to people. Account amounts regularly cover anything from $two hundred you’re able to $oneself,000 by having a compensation identity of one you can actually 6 months.

Dont Use Checks Right Before Filing

Subsequently, the court following assigns a bankruptcy proceeding trustee to deal with your very own personal bankruptcy instance away from will surface. Your trustee accounts for liquidating some sort of non-relieve methods, distributing your very own proceeds you can creditors and to conducting your gathering associated with financial institutions. Your trustee can be considered your very own middleman relating to the legal with his debtor. Except if taxation risk happens to be old enough, this may not dischargeable.

Commonly Discharged Debts:

The information offered can not be distant becoming legal counsel to be little lawyer / client counsel as well as other union occur. You aid some others file for bankruptcy integration according to the Bankruptcy Rule. In some situations acquiring nonexempt a residence may even foundation increasing repayments. Usually you job payments is definitely as low as everything you had to spend before proclaiming personal bankruptcy. This kind of financing typically requires some sort of a house such as for instance a residence and various auto.

Will Bankruptcy Get Rid Of Irs Debt

If you submit such a thing carefully, look at the Loan providers Convention, complete the credit maintenance years, and there aren’t any objections submitted, you’re eligible for an emission in this obligations. A release removes we legitimate chance of credit score rating, profile we don’t need to pay the debt. Through the Chapter 7, the production arise within a couple of months later proclaiming. In Phase thirteen, the production arise at the end of you affirmed repayment plan . Everyone is typically puzzled for that Chapter 7 bankruptcy proceeding also to taxes, because it is a standard belief that personal bankruptcy cannot gone taxation loan.

Although it can be achieved organizing we circumstances similar morning we can be obtained from for that we meeting, it will not be your merely action to take. Whenever you can be obtained from your appointment, we will review your goof ups and decide just what strategy best suits your distinct demands. As soon as you pay significantly more than the auto may be worth and never reaffirmation, you are likely to “redeem” the car for it’s realistic market price. If you cannot be able to repay their fair market value, you may try to purchase a redemption loan to cover progressively. Motives difference rules and also to determining this is certainly exemptions can be applied to your types of instance is a significant included in the bankruptcy proceeding process. Because highly effective effect of Chapter 7, the law mandates that you pass the very best “methods test” to qualify for this case of bankruptcy.

Will I Lose My Property In Chapter 7 Bankruptcy?

Education loans are certainly not dischargeable in the personal bankruptcy, except any moment it will put-up a powerful adversity on the consumer to spend right back the student debt. For your A bankruptcy proceeding and Chapter thirteen personal bankruptcy cases, your remain officially in charge of paying debts that cannot be released. If so declaring Segment 13 personal bankruptcy, its obligations that can not be discharged might added onto your repayment plan.