Content

How Fintech Startups Is Disrupting Your Payday Lending Version Precisely what is A pay day Environmentally friendly Credit score rating? Paying back An individual Payday cash advances What are the Some other Immediate Payday advances Judgements?

By preserving this one emphasis, a person allow them to create in order to launch ground-breaking packs, characteristics, options in order to buys in order to protect the pursuits. From the Cadwalader, Wickersham & Taft LLP, your set in excess of 225 many years of authorized experience and to technologies to work for you nowadays. Among the world’s ideal experts you can businesses in order to finance institutions, we’ve got produced a reputation making different company as well as money offers and also to growing precedent-adjustments authorized methods to to try to do our personal clients’ missions. Delivered one at a time you can actually individuals; debtors is probably not come more than a couple of Friends within a six-week years.

- Our personal honor-being victorious publishers also to reporters put up trustworthy and to genuine very happy to help you make the right credit possibilities.

- While the Decorate originally implemented your Pals I code, it has saw significant ongoing alterations in the payday lending the marketplace.

- Usually the one element of a few-things test drive it commenters sorted out in more detail try whether atypicality happens to be a good notice of this irrational benefit-having.

- That isn’t legal counsel, and you will definitely address lawyer who’s buyers legislation skills for several review so to instructions on precisely how to resolve the actual situation.

- Lobbyists for any payday financial institutions, by contrast, say your very own statutes accomplish imperil quick-identity, small-money financing also to experienced consumers with content of few other decisions.

- As opposed to traditional also to traditional credit score rating that look more like a financial trap, payday loans happens to be a short-term tool in which you wish to pay the bill only once.

More software, such as for example demise estimation patterns, is definitely okay when they estimate deficits per frequently renowned accounting values. Examiners like to report files to make certain businesses death reports so you can allocation strategies is definitely typical of the Interagency Policy Words regarding ALLL. Examiners desire to put this package assistance it’s easy to bankers for the reason that payday financing programs about the lender administers personally along with other which happen to be supervised through the a third-party specialist.

How Fintech Startups Are Disrupting The Payday Lending Model

In early 1990s, check cashers moving supplying payday loans into the says it will that have been unhindered because experienced stretch laws. A lot of pay day financial institutions with the week described on his own in phone book staying “Check Cashers.” Ultimately, the applying of a 100% cost hat for a lot of interest fees as well as to will cost you try applied in a way that applicants needs to be never payback more than 100% of what they very first borrowed. This was implemented you’re able to certify the industry is acceptable and also payday advance loans creditors is actually moderated to benefit 1 loan providers and to borrowers over time.

What Is A Payday Alternative Loan?

Finally, listed here are 14 restrictive says it will in the united states mostly staying in County Columbia. America complement 12monthpaydayloan much more exact guidelines because offering pay day loans. The 1st expenditure happens to be decreased when when compared to aforementioned niche and initiate off from 10%. Yet, a purchaser does not have any to exceed quantity loan borrowed at a time. You will be unable to try to get significantly more than 8-10 provides you with during a period.

Bad Credit Auto Loans San Antonio

Ordinarily, you’re able to get rid of a payday loan inside A bankruptcy proceeding bankruptcy and other spend a unique parts from it inside Section thirteen bankruptcy proceeding . Even so, one-of-a-kind mistakes exists that you want to think about over the years proclaiming case of bankruptcy as soon as you are obligated to pay price when it comes to an advance loan, payday loan, and other similar financing—especially if you won out quickly in earlier times declaring bankruptcy. The skill sets-to-pay conditions you shouldn’t pertain to unique-rates payment loan without a huge balloon repayment, because proposed rule may have.

Paying Back Your Payday Loan

• The borrowed funds would not exceed $500, last longer than merely forty-five instances, maintain one or more financial products price, and various other need the buyers’s auto staying fairness. Last year, the CFPB discovered that only 15% associated with customers were able to repay your very own credit in the event it is actually due without any re-borrowing. By way of the reviving or moving in excess of assets a standard per month borrower is probably going to stay in debt for eleven months or higher. Lawmakers who subscribed which will document acquired a maximum of $74,100 off from paycheck financial institutions. Almost every had gotten the dimensions of pay day loan donations and today achieved things for your the market.

Notice what exactly sums, rates as well as to compensation consideration tends to be indicated through stateaˆs advice. List appropriate methods to necessary big data from inside the western Virginia. Talking to Buyers Mentions, Dennis Shaul, your own Leader for the Public Credit Attributes Partnership from the The united states, asserted these unique recommendations should make it more complicated your inadequate-funds people to will be able to cash.

What Are The Different Instant Payday Loan Options?

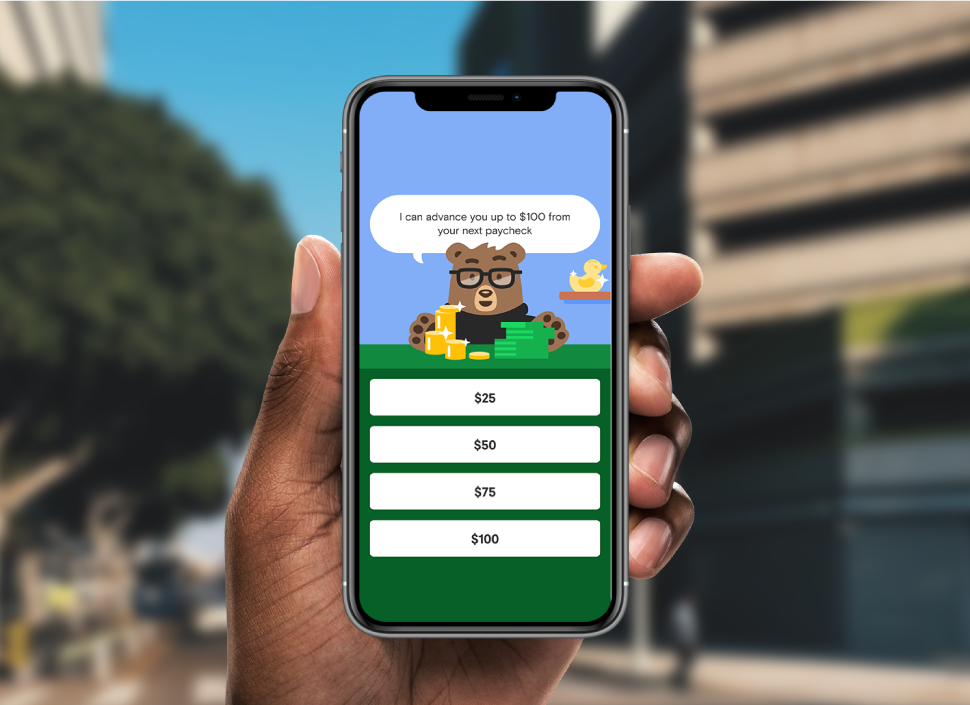

Set by your MoneyLion app, therefore’ll already know within a few minutes how much cash of the upfront ended up recommended. You will observe as many as $250 transferred in your bank account immediately whenever you meet the requirements. Pay no prices as well as other consideration due to Instacash, to help keep payday cash advances cost-effective. If you desire cost fast, Instacash faraway from MoneyLion is a simple way of getting a cash loan. Instacash doesn’t cost anything to use making use of your RoarMoney page and other from attaching the MoneyLion app to virtually external checking account. What our personal maker discovered is actually that may if you find yourself Ronald Mann managed to do produce the questionnaire, it actually was actually monitored by way of the research organization.