Blogs

To have firefighters, pay initiate in the 15 per hour, the brand new federal minimum wage, to own admission-height positions, which increased inside the August 2021 of 13. So it message has aided a large number of somebody prevent holding to https://vogueplay.com/au/house-of-fun/ possess a representative. However, more than six,one hundred thousand people each day still like to waiting to speak to help you a realtor regarding the Work. These types of calls, along with group and appointments inside regional workplaces, will continue to boost across the upcoming weeks and months.

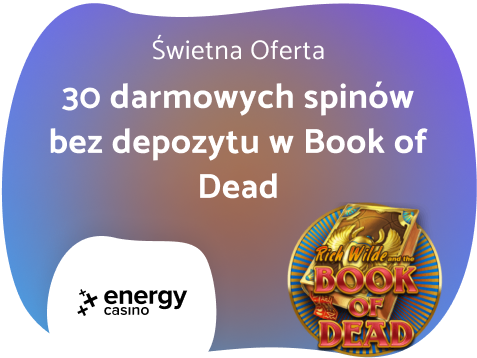

- We’ve got said exactly how we experienced while playing with this incentives, but we understand that each and every player’s experience may vary significantly.

- For individuals who qualify, you can also decide to declaration your child’s earnings of more than step 1,300 however, lower than 13,100000 on your taxation get back by the finishing function FTB 3803, Parents’ Election so you can Declaration Kid’s Interest and you will Dividends.

- To own reason for measuring restrictions centered AGI, RDPs recalculate its AGI having fun with a federal professional manera Form 1040 otherwise Form 1040-SR, or California RDP Changes Worksheet (located in FTB Pub. 737).

- If you need to amend their California resident tax go back, complete a revised Function 540 2EZ and look the package in the the top of Setting 540 2EZ appearing Amended go back.

- Generally, you should spend Ca play with income tax to the orders from gifts to possess use in Ca produced from away-of-condition providers, for example, because of the mobile, online, by the send, or perhaps in person.

Biden signs bills having money to have provided firefighters, sky site visitors uses

If you entered a price on the internet 98, subtract they regarding the amount on the web 97. Love to fully grasp this entire amount refunded for your requirements or generate voluntary contributions using this matter. Discover “Volunteer Contribution Financing Meanings” to learn more. If you are not claiming people special credits, go to line 40 and line 46 to see if your be eligible for the fresh Nonrefundable Man and you may Dependent Care Costs Borrowing otherwise the newest Nonrefundable Occupant’s Credit.

You are leaving ftb.ca.gov

The newest election is going to be generated on the exclusive, quick filed get back and that is irrevocable on the nonexempt year. Impacted taxpayers is consult a supplementary rescue months if your condition postponement several months expires before federal postponement months because of the processing form FTB 3872, California Emergency Rescue Request for Postponement of Taxation Work deadlines. For more information, rating form FTB 3872 and find out R&TC Area 18572. Online Doing work Loss Suspension – For taxable years beginning on the or after January step 1, 2024, and you will before January step one, 2027, California have suspended the web working losses (NOL) carryover deduction. Taxpayers could possibly get always compute and you can carryover an NOL in the suspension system several months. But not, taxpayers with net organization money or altered adjusted gross income of below step one,100000,100000 otherwise with crisis loss carryovers aren’t influenced by the newest NOL suspension regulations.

For more information, get mode FTB 3514, Ca Attained Taxation Borrowing from the bank, otherwise visit ftb.california.gov and appear to own yctc. We all know one certain push posts have said instructors, firefighters, police officers, and other societal group when revealing the newest law. But not, only individuals who receive a pension considering work not secure from the Social Security often see benefit expands. Very county and local societal staff – in the 72 percent – work in Personal Protection-secure employment in which they shell out Social Defense taxes and are perhaps not affected by WEP otherwise GPO. Those individuals does not discover a benefit raise because of the the new rules. Specify the new pending legal actions otherwise mention of government devotion on the Region II, line 2 so we is properly processes the allege.

- The newest totally free processor chip will act as a good inclusion to the casino, sufficient reason for Brango’s strong profile as the an established RTG-pushed webpages, it’s just the thing for newcomers.

- Because the WEP decrease pros to own resigned otherwise handicapped pension pros that have under 30 years away from tall money out of a job covered by Social Security, the new GPO targets the new partners away from retirement specialists.

- In case your count on the web 31 are less than the quantity online 21, deduct the amount on the web 31 regarding the matter on the web 21.

- While this is an intensive listing of the greatest label put prices obtainable in Australian continent, we don’t make certain that all the products in the marketplace get.

- We might along with enforce penalties to possess carelessness, ample understatement of tax, and you will ripoff.

- Prior to joining Newsweek inside the 2023, the guy led each day guides inside Northern and Sc.

Should your boy must document function FTB 3800, Income tax Calculation for sure People with Unearned Income, along with your taxable income changed, comment your son or daughter’s income tax return to see if you will want to document a keen amended tax come back. Create voluntary efforts out of step 1 or maybe more in whole money amounts to the fund detailed lower than. To help you subscribe to the new Ca Seniors Unique Financing, make use of the recommendations to have code eight hundred less than. Extent your lead both minimises your overpaid taxation or expands their tax due.

Credit Graph

Intangible Fucking and you may Development Costs – California legislation doesn’t allow IRC Part 263(c) deduction to own intangible screwing and you can development will set you back in the case of oil and gas wells paid or sustained to the otherwise once January 1, 2024. To learn more, come across R&TC Part and have Plan P (540), Option Lowest Income tax and Credit Limitations – Residents, form FTB 3885A, Depreciation and you will Amortization Modifications, and you may FTB Pub. Conformity – To have condition away from federal acts, visit ftb.california.gov and search to possess conformity. When you have a tax responsibility for 2024 or are obligated to pay any of one’s following taxation to possess 2024, you ought to file Form 540.

Indication The Taxation Return

When you are submitting your amended income tax return following normal statute out of restriction several months (number of years following deadline of your brand-new taxation come back), attach an announcement outlining why the normal statute from limits really does maybe not apply. Contributions made to which finance might possibly be distributed to the space Department to the Ageing Councils (TACC) to include advice on and you can support of Elderly people points. You’re not authorizing the newest designee to get one refund look at, bind one to anything (as well as any additional taxation liability), or otherwise represent you before FTB. If you would like grow or alter the designee’s authorization, go to ftb.california.gov/poa. For many who file a shared taxation get back, your companion/RDP are often responsible for income tax and you may any attention otherwise charges due to your income tax get back.